Microbiome-targeting medicines: Commercial launch is moving centre stage

…even in Europe

The novelty of microbiome-targeting medicines and few commercialised

benchmarks bring major unknowns on the way to product launch

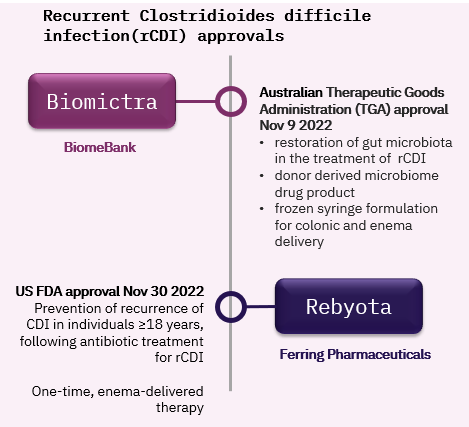

With the first faecal microbiota product approvals for recurrent Clostridioides difficile infection (rCDI) in November 2022 the commercialization, reimbursement, and launch of microbiome targeting products is starting to move centre stage.

The approvals are a milestone that can help to further establish microbiome targeting therapies as standardised save medical treatments, and provide the medicinal product status that presents a key requirement for routine insurance reimbursement eligibility. This is an important distinction to nutritional and food supplement products or cosmetics, that are generally consumer health products, not covered by health insurance. Most of all, the two newly authorised therapies and the rCDI indication as a whole will provide an important case study of commercialisation, adoption, acceptability and competition.

There is scientific promise in microbiome treatments that is reflected in these

authorisations But with relatively few microbiome treatments at the commercial stage, significant unknowns remain on the way to commercial launch of microbiome targeting therapies. Currently industry has few benchmarks to learn from, and there are still significant knowledge gaps for stakeholders including physicians, Health Technology Assessment (HTA) bodies and patients.

While Europe may lag behind in marketing authorisation for microbiome medicines, commercial opportunities exist and will continue to grow

While Europe still lags behind in terms of microbiome medicines approvals, there are reasons to keep an eye on the different markets for the stages beyond regulatory approvals.

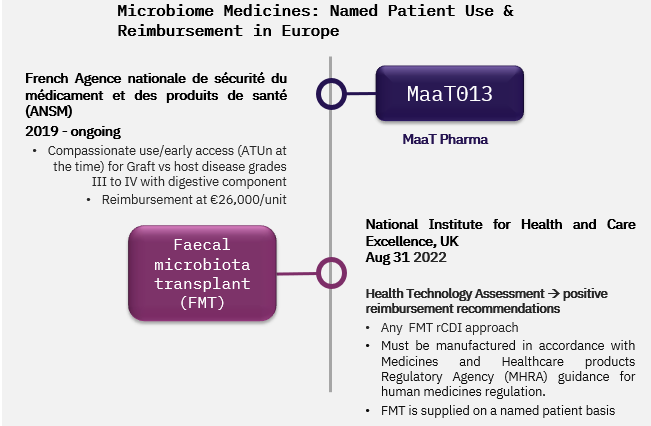

In the UK, we have seen the first Health Technology Assessment (HTA) for microbiota medicines in the form of a NICE Medical Technologies Guidance with reimbursement recommendation for FMT for rCDI. The HTA is non product-specific and looks at different delivery routes; it focuses on the evidence for the treatment approach in the indication in general. But other healthcare systems in Europe have a more reluctant outlook on FMTs which formally remain medicines without marketing authorisation.

However, in France MaaT Pharma’s MaaT013 for Graft vs host disease is available to patients through an early access scheme since 2019. This is a reimbursed programme with a price point that will serve as a benchmark for commercial reimbursement negotiations in France and potentially in Europe.